9.1.2.2 Yield Curves

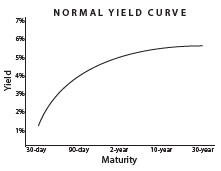

A yield curve is a graph that plots the interest rates of bonds that have equal credit quality but different maturity dates. Yield is on the y-axis and length of maturity (time) on the x-axis. The yield curve illustrates the cost to borrow and investor expectations about risk. Typically, bonds with longer maturities offer higher yields than bonds with shorter maturities. This is represented by a normal yield curve which slopes upward from left to right. The normal yield curve reflects an expectation of inflation and growth, as maturities increase so do yields. In the normal yield curve longer-term borrowing costs more than short-term borrowing. This is because the more time to maturity, the longer investor’s money is at risk.

If investors see the future as particularly volatile or uncertain, the spread between long- and short-term bonds may widen. This makes for a steeper yield curve. Investors demand to be compensated, in the form of higher yields, for the increased uncertainty that comes with a longer time period until the bond reaches maturity.

Occasionally, the yield c